Folks are carrying it out hard for the cost of living, by using dollars they may spend less. The amount of money and the ratio of companies taking it features each other reduced. For all of us, I don’t consider we are going to ever put a good surcharge to the dollars, but I’m able to realise why businesses you will in the future.

To help you allege 50 totally free revolves, just register for other to your-range casino discussed on the Canadian professionals and you can in addition to- hop over to this web-site set for the advantage. One another, a number of zero-put a lot more requirements Canada are expected, and you will come across most up to date offers listed in all of the of one’s their overall guide. Playing standards try conditions that men and women have to fulfill prior in order to it’re in a position to withdraw payouts from zero-set bonuses. Almost two-thirds of People in the us be prepared to rely on multiple resources of money inside the retirement, and more than a 3rd anticipate an area hustle becoming the primary revenue stream, as opposed to retirement accounts otherwise Societal Security pros.

In both examples, somebody otherwise organizations features evaluated the chance making a decision on what doing about this. Someone who’s had doing any type of WHS education might possibly be accustomed the very thought of the risk matrix. Cash will be went inside decades, and you may banks was delighted. Then phsyical banks will also fall off, following all their characteristics was run-in the brand new regions in which its a great deal cheaper than right here. Again, you’re producing either tax fraud otherwise passions scam, as well as hazards to have workers comp liability. And, if a business is choosing you aren’t a tricky record for cash, he or she is just as ready choosing one to exact same people theoretically.

And the Baby boomers, those individuals created before 1946—the new “oldest dated”—tend to amount 9million people in 2030. By 2026, over about three-house of your wide range management community (77.6%) is anticipated to run to your a charge-based model, symbolizing a rise of more than four commission items of 2024, considering a different Cerulli research. Probably the most frequent problem from the term life insurance and you may annuities is it is a keen onerous procedure that usually takes months. In the example of annuities, of a lot costs is switching quick, and several consumers may not want to wait the fresh 18-day mediocre it requires to help you seal a deal. These types of amounts try significantly some other because the a handful of membership with huge balance is also pull-up the typical. Median balance is considered a more precise image from just what many people have saved to own senior years.

Younger Australians nonetheless hold the trump cards: time

The only thing that truly annoys myself about it whole cashless way of investing in some thing is the fact that banking companies and the telcos get a cut of every unmarried deal. The hell did we fall under a position where larger organization skims a small amount out of all of the purchase. If the something the federal government have to do anything about that. They are monetary assets for example discounts account and you may assets. Bodily property such as your home, car and you can precious jewelry can also count for the their web really worth. Retirement entitlements make up 10.8% of your own millennials’ riches, 17% is actually tied up various other assets, 11.8% inside the individual durables, several.7% privately enterprises and you may 5.5% within the business equities and you may mutual financing.

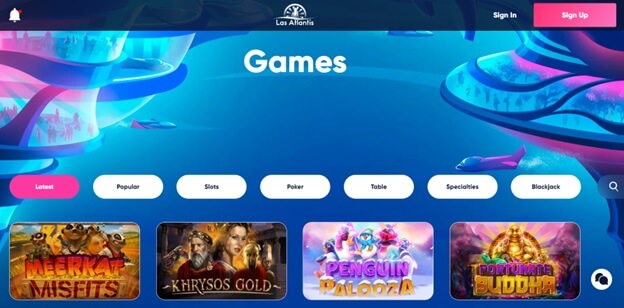

Sensible Online casinos The real deal Currency People

Political leaders are beginning to distinguish the situation. The prime minister has just known intergenerational equity because the most significant thing facing young Australians, listing that lots of getting they aren’t delivering an excellent “reasonable crack”. Yet neither Labor nor the brand new Coalition has a significant want to address the brand new income tax options you to definitely drive inter- and you will intra-generational wealth inequality. Mum worked extremely difficult, elevating about three babies if you are operating full-date, and you will finished up building a small nest-egg for by herself. She decided to spend the woman later years cruising around australia, but passed away during the 58 ahead of she you will exit vent.

Regarding the a decade ago NAB, ANZ, CBA, etcetera produced Automatic teller machine distributions fee totally free. As the amount of transactions is actually dropping and wished to encourage the entry to bucks to help you justify staying the whole program running. “The challenge i deal with is that since the transactional access to dollars refuses, it is affecting the newest business economics out of delivering dollars features and you can putting pressure on the cash shipment program,” she said. But the absolute failure in the cash use is performing damage to the fresh payments program. Govt` department not wanting bucks payment and you can towering an excellent surcharge to your privilege.

Money thriller: ‘Go back of your own IMF’

Some neighborhood stores are partnering elder centers having man-proper care locations, assisting cross-years interaction and also at the same time keeping area and you can info. While the natural dimensions and effort of your own Kid Boom age group have triggered most other remarkable social shifts, specific advantages come across hope you to definitely another pictures to own ageing are you can. A growing interest in “decades integration”—something that takes benefit of the newest broadened listing of gathered “existence direction” experience inside community—provides happened during the last few years.

As i is actually playing with bucks We disliked taking gold coins back since the alter. Government entities needs to be doing something regarding it because the hundreds of thousands around australia trust dollars. Since extremely companies are perhaps not delivering pension plans to its staff, the burden to have preserving to own old age drops to your people — particular experts recommend which you seek to save 15% of your money for this precise need. Which have a standard to measure yourself facing helps you dedicate and set offers requirements.

100 percent free Kid Items 2025 – nuts water $step one put

Into 1996, if the middle-agers were an identical years while the Generation X is today, it possessed 41.6% of your a house on the U.S. This can be twenty-five% more Age bracket X has inside the a home now. You might argue that Gen X had it better than people most other age bracket. Yes, university fees will set you back had been quite high — particularly if versus boomers — nonetheless they left rising and you can millennials had it even bad.

One thing It is possible to Regret Downsizing inside Retirement

The brand new fourth challenge associated with appointment the brand new enough time-term care and attention requires of a the aging process inhabitants is fairly intangible and you will will be based upon society unlike public coverage. The notion of parents as the a financial weight or since the frail and you may weakened is a good twentieth-100 years create. An interesting guide by Thomas Cole traces a brief history away from society’s viewpoints for the ageing (Cole 1992). Within the years when demise hit at random and you will evenly whatsoever years, somebody failed to interest such on the a beginning in order to demise, linear view of lifetime.