Articles

When you yourself have $250,000 or smaller placed within the a bank, the brand new changes will not apply to your. The newest funds these types of partnerships make provides the ability to spend the higher team from publishers for their functions, in addition to continue to increase the web site and its particular blogs. But not, it can be time-ingesting trying to stay on better of now offers that are constantly changing.

The new costs, terms and you may charges shown is actually precise in the course of publication, however these alter tend to. We advice confirming to the resource to confirm probably the most right up thus far advice. An important is looking a keen FDIC-covered family savings that actually works most effective for you. You might https://happy-gambler.com/5-dragons/real-money/ require overdraft defense and the power to earn cash return on your own sales. Along with, just remember that , a lot of banking institutions don’t deal with American Display otherwise Find to have credit card financing, so you’ll really need best fortune which have a charge otherwise Credit card. When you’re an entrepreneur in the market for an alternative bank account, definitely read this offer of Lender from The usa.

High-give savings Faqs

You’ll also need to keep at the least $step 1,100 on the membership to earn the brand new APY. Along with a bank account, you could open a bank account and Cds from the Ascending Bank, several of which provides aggressive efficiency. They are finest-scoring accounts for certain Video game terms, anywhere between a month to 10 years.

Points

If you exit $ten,100 inside the a family savings one pays cuatro per cent APY to have a year, it is possible to earn as much as $400 inside the desire. Inside the a vintage family savings in the 0.01 % APY, you’ll be able to secure to one dollar. Whether or not rates is actually less than these people were this past year, they’re nonetheless large nevertheless outpacing rising prices by a wide margin. By Summer 2025, the rate from rising prices, season-over-12 months, are 2.7 percent according to the Agency out of Labor Statistics’ User Price List (CPI). Since the Federal Reserve is anticipated to chop the newest government fund price from the second half of 2025, now’s a lot of fun to start a good Computer game to help you lock in higher rates ahead of they fall. Vanguard Brokered Licenses of Put’s you to-few days Computer game rated one of the better total Cd prices.

- You’re not entitled to found a personal checking account incentive when the you’ve kept a good You.S.

- Owners Financial only also provides Atm reimbursements for non-Owners Financial ATMs, around $10, to possess People Private Consumer Family savings customers.

- None Atomic Invest nor Nuclear Brokerage, nor any of its affiliates are a lender.

Also, you could potentially optimize which promo by and opening another private checking account — stacking a supplementary $three hundred or $150 besides render for a maximum of upwards to help you $500. Morgan Wealth Management offers up to a great $700 greeting bonus once you discover an alternative Notice-Directed Investing account with being qualified minimal financing. Keep in mind that some of these membership are available across the country, and others might only be offered in the states in which the bank operates actual branches.

This could mean that the services of another money agent that have who we’re not interested can be more right for your than simply Nuclear Dedicate. Consultative features due to Atomic Dedicate are made to assist subscribers within the gaining a good outcome inside their financing collection. To get more factual statements about Nuclear Dedicate, excite understand the Function CRS, Form ADV Area 2A, the brand new Online privacy policy, or any other disclosures. The alterations haven’t in person inspired bank bonuses, nevertheless you are going to nevertheless be a lot of fun to open an excellent the new checking account however if savings account rates of interest slide. So you might benefit from one another a financial added bonus and you may newest APYs in the another checking account.

The brand new Dough Cashback Credit produces 2% cashback on the all the orders if you are using the credit. Money might be redeemed since the a statement credit or head deposit to the family savings. In addition to bank offers, another way to earn bonus dollars without needing to install direct put would be to talk about bank card also provides. Checking profile try designed for your day-to-day transactions — they have been for which you continue money you are thinking about spending. Discounts profile are supposed to keep currency that you’re seeking separate from the currency you might be investing. An informed examining profile do not have monthly fees and may pay your specific desire, also.

TD Complete Bank account

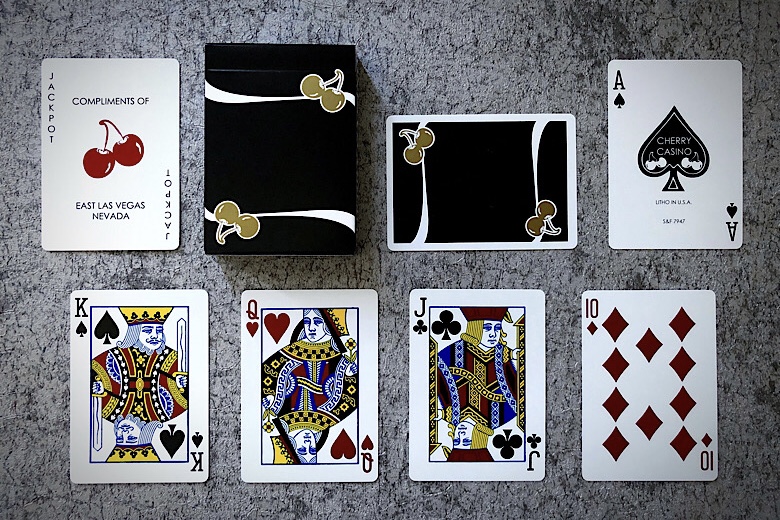

It slot is the same which have 5 reels and you can 20 paylines, which is extremely quick which you play the game on your tablet otherwise cellular telephone. The convenience of so it position mode there are 5 reels and you will just 20 paylines. You are going to become sentimental out of to try out inside arcade places, but you’ll find it surely overwhelming. There’s excessive one to, as well as if there’s a single extra, you wear’t end up being you’re at a disadvantage. The newest slot machine is easy and you may productive that is created by Microgaming that have 5 reels and you can 20 paylines, and win each other indicates. The proper execution with this slot arises from an old research and vibrant bulbs.

You to Medical allows insurance such an everyday doctor’s place of work

Once you open an excellent TradeStation membership to make a great qualifying put, you can generate a great $150 incentive. You’ll need to take the newest promo password TSTVAGLL whenever opening their membership. You could potentially participate in that it bonus give only when inside a good 12-day months regarding the past subscription date. For other well-known costs energized by the Owners Financial, you could potentially avoid them that with just Owners Bank ATMs, ensuring that you wear’t overdraft your bank account and you can going for on the internet comments. I appeared simple-to-subscribe loan providers one to NerdWallet provides vetted and you may reviewed to your highest cost with no-punishment Dvds. Inside September 2024, the new Government Put aside made its the best cut-in number of years.

« When you are because form of boots, you have got to work at the financial institution, because you might not be capable personal the fresh membership otherwise change the account until they develops, » Tumin told you. Per beneficiary of the trust could have a great $250,one hundred thousand insurance rates restriction for four beneficiaries. However, if there are more than simply five beneficiaries, the fresh FDIC exposure limit on the believe membership remains $step one.25 million. Beneath the the newest laws and regulations, faith places are now restricted to $1.twenty five million inside FDIC publicity for each faith manager for each and every covered depository business.

Their concern offers objective, in-depth individual fund posts to make sure clients are very well-armed with knowledge when designing economic decisions. All accounts integrated on this number are FDIC- or NCUA-covered as much as $250,000. It insurance policies protects and you can reimburses you to what you owe and you can the fresh court limit if your lender or credit union goes wrong.