The new London Steel Change (LME), for example, will not make it copper futures to be bought and sold because of the retail people. These players usually as an alternative have to choose an option exchange such the brand new CME or Ice to complete company. Futures are often used to trading numerous assets and merchandise, equities, indices, ties, cryptocurrencies, rates and foreign currency. Its really worth are sourced (or derived) from the price of a main resource, even if crucially a trader doesn’t need to own said investment to trading these types of agreements. Control allows traders to deal with a great number of the underlying investment which have a relatively few investment, called margin. Dispersed assets across the segments requires training and you can continued reputation overseeing, which could result in even worse exchange consequences.

Futures and choices are derivatives, financial tool produced from the value of underlying possessions for example commodities, currencies, or indexes. The key difference will be based upon the brand new loans it enforce to the consumers and you may providers. When you are much has evolved while the forward have become standardized while the futures agreements and exchanges provide previously-more-advanced things, the fundamentals are still the same. Lower than, i make suggestions from kinds of futures, whom deals her or him, and exactly why, all the while you are showing which you wear’t need for the horseback to beat reports of a grain-filled vessel arriving to get from these opportunities. Just as in change carries or other monetary property, it is necessary to possess buyers to develop a plan for exchange futures you to definitely contours entryway and get off tips in addition to risk government regulations.

Guess a mutual fund manager oversees a profile cherished during the $one hundred million one music the newest S&P 500. Worried about possible brief-name field volatility, the new finance manager hedges the fresh profile against a prospective business downturn having fun with S&P five hundred futures deals. The last change day’s oil futures, for example, is the final date you to definitely a good futures package could possibly get trading or getting closed-out prior to the birth of one’s hidden advantage otherwise cash payment. Usually, most futures lead to a funds payment, rather than a shipping of one’s actual commodity. It is because almost all of the marketplace is hedging or speculating.

As with any futures deals, product futures are often used to hedge or protect a financial investment position or even wager on the new directional direction of one’s fundamental resource. Futures is actually exchanged due to unlock outcry inside trading pits inside the an auction otherwise as a result of digital monitor-centered possibilities having central exchanges such as the Chicago Mercantile Change. There are also cryptocurrency exchanges such Binance one to change futures, along with those with and you can instead a conclusion day. The new role of one’s futures change isn’t to buy otherwise sell the fresh deals however, allow deals, make sure that he is legally presented, check that it stick to the exchange’s laws, and you may publish the newest trading rates.

Cryptos

At the same time, speculators change futures agreements just to profit from price action. It wear’t wanted the root assets but purchase or offer futures dependent to their predictions on the upcoming costs. Organization people were elite advantage managers, pension financing, insurance providers, common financing, and you can endowments. They dedicate large sums of cash in the monetary tools, along with futures agreements, on the part of the stakeholders otherwise beneficiaries. From the futures business, organization people get take part in hedging to guard their profiles of unfavorable market movements or speculate on the coming speed recommendations to compliment output.

But if https://key-sports.com/report-trade-definition-how-it-operates-systems-benefits-restrictions/ you trade intraday – definition you wear’t hold a position from one class on the next – brokers could possibly offer a reduced margin rates. Private buyers, specifically, are supported exchange futures on the Age-Mini deals. Futures are specifically preferred from the higher levels of power you to definitely buyers tend to play with.

Exactly what are the requirements to start a good futures account?

- Futures agreements is actually agreements where a buyer and you may a merchant assent in order to trading an excellent pre-calculated quantity of a secured asset for an appartment rate on the a evening out for dinner.

- It also given all of them with comfort by permitting them to hedge facing losing costs.

- Worried about possible short-label industry volatility, the new financing manager bushes the fresh portfolio against a prospective field downturn having fun with S&P five-hundred futures deals.

- Trade that have an excellent multi-regulated representative who has centered long-status partnerships with better global banking institutions to make sure their fund will always be safe.

And also as I’ve along with explained, the fresh widescale way to obtain leverage contributes additional risk. For these reasons, the brand new traders must setup a lot of time and you will effort to find out just how such bonds performs before they begin exchange. You to huge advantage of futures exchange is that large degrees of power are available. In reality, the application of lent cash is it is common in the to shop for and promoting ones contracts.

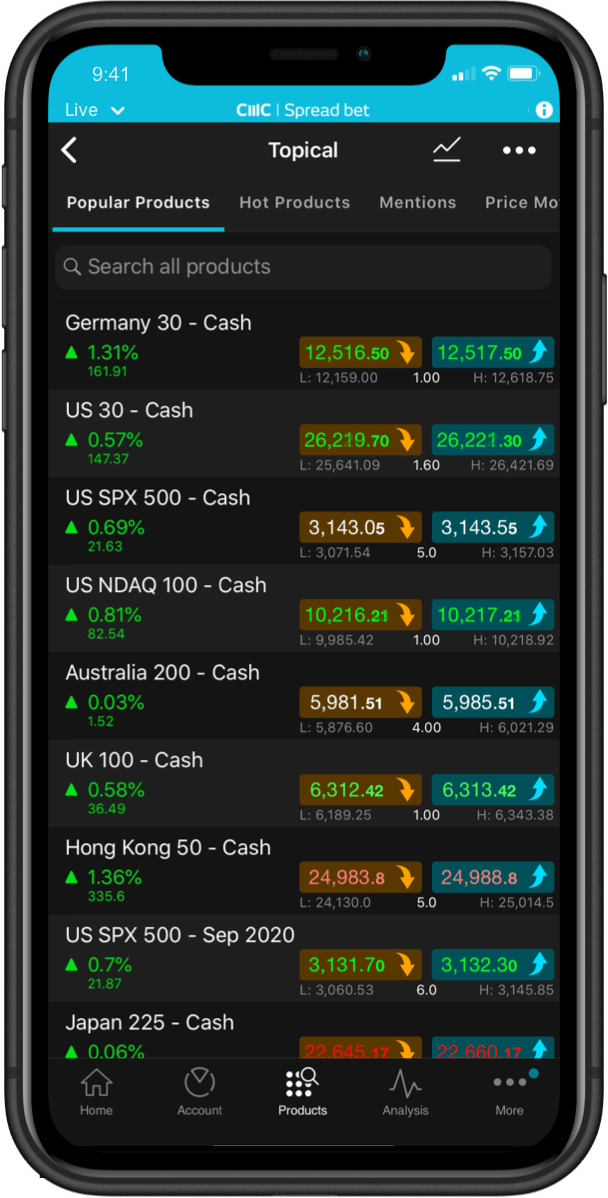

To place your very first trade, go to our very own trading system and pick market. 2nd, get the ‘Futures’ loss to the rates chart (otherwise ‘Forwards’ in the event shares, fx and ETFs), pick if we want to pick otherwise promote the root business, and pick your situation proportions. To the our cellular app, futures and forward locations is indexed on their own to understand and money locations. Other locations, for example gold or silver commodity futures are desirable to people who’ve lower risk appetites and luxuriate in segments with all the way down volatility. Think of, we offer futures and you will forwards to the indices, ties, interest rates, shares, fx and you can ETFs.

Choose whether or not to wade a lot of time otherwise small

Because the a good investment tool, futures deals provide the advantageous asset of rates speculation and you will risk minimization against possible business downturns. Getting an other reputation whenever hedging can result in a lot more loss in the event the field forecasts are out of. And, the new everyday payment away from futures rates introduces volatility, for the investment’s value switching significantly from one trade example so you can the next.

What is actually Futures Exchange?

If a person takes an extended position, as well as the payment price is greater than the new admission speed, they’re going to discover a money payment. Furthermore, traders whom initial ran quick and you can sold a good futures package have a tendency to receive a commission if the settlement pricing is below their admission speed. In case your market motions from the reputation, people you’ll deal with margin phone calls, demanding more income to be transferred. In the event the this type of margin conditions commonly fulfilled, then your position can be signed at a loss.

After you’ve composed an account, you can log on to all of our prize-profitable exchange program. Delivering responsibility for your change behavior are an extremely important aspect when you’lso are change within isolated means, can seem to be for example a difficult activity. But it’s also essential when planning on taking duty for points for instance in which your internet falls in the middle of a swap.